by Dean Barta | Mar 15, 2024 | Accounting, Bookkeeping

The construction industry, particularly for homebuilders, presents a unique set of financial challenges. From managing project budgets to tracking inventory and ensuring timely payroll processing, the economic health of a homebuilding business hinges on meticulous...

by Dean Barta | Aug 4, 2021 | Accounting, Bookkeeping, Tax Deductions

Tax Deductions for Painters One of the major positive aspects of owning and operating your own business is the tax benefits. Business owners can take tax deductions and credits for a variety of business expenses. For painters, their service is important to their...

by Dean Barta | Jul 7, 2021 | Accounting, Bookkeeping, Tax Deductions

Tax Deductions for Landscaping Companies Like any small business, owning a landscaping company requires you to juggle many tasks, including job estimates, managing your work crews and handling finances. With everything going on in your business, it may be hard to sit...

by Dean Barta | Jun 23, 2021 | Accounting, Bookkeeping, Tax Deductions

Tax Deductions for Auto Mechanics Taking legitimate tax deductions is one way to reduce the amount of income tax you must pay. So what are some the best tax deductions for auto mechanics? Barta Business Group, an accounting firm in Denver, Colorado, outlines what...

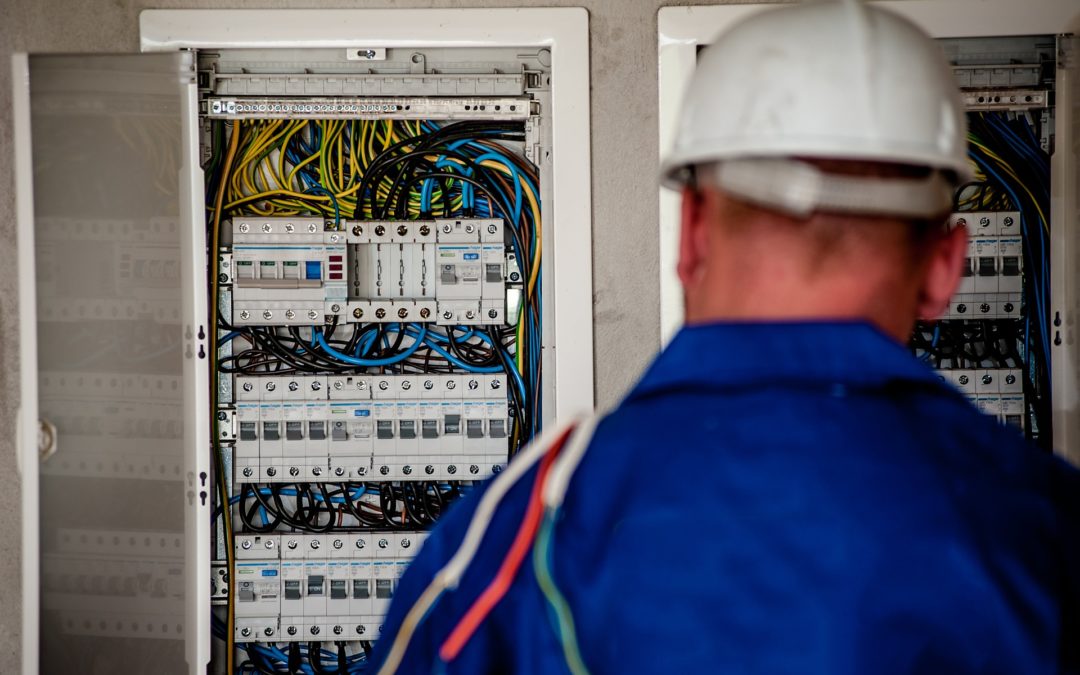

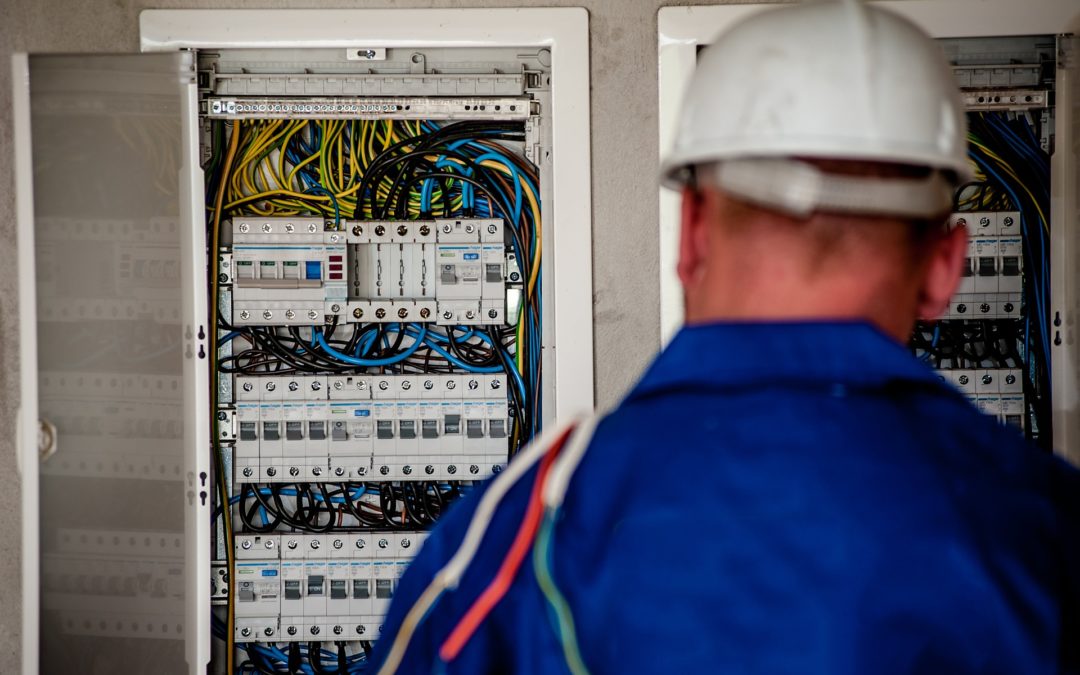

by Dean Barta | Jun 9, 2021 | Accounting, Bookkeeping, Tax Deductions

Tax Deductions for Electricians Tax season doesn’t have to seem like a nightmare to your electrical company’s bottom line. Part of setting your small business up for success is maintaining good bookkeeping records that track all your expenses. Simple items that you...